Fed’s Inflation Dilemma: Tariffs, Rates & Economic Uncertainty

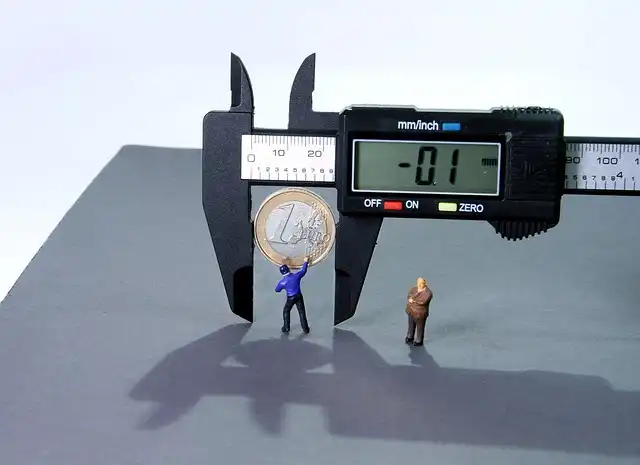

The Fed faces inflation challenges amidst trade tensions and economic uncertainty. Tariffs, energy costs, and labor market rigidity influence the Fed's cautious approach to rate cuts. Stagflation remains a risk.

It’s not just the profession war influencing the Fed. It’s additionally the bigger image. Rising cost of living, though cooling, is still above the central bank’s 2% target and continues to be volatile. The complete influence of Trump’s “Freedom Day” toll statement didn’t appear in April’s CPI information.

Inflation Concerns and the Fed’s Strategy

Powell has emphasized that the central bank is focused on achieving “better confidence” that rising cost of living will certainly return to its 2% target, instead of awaiting it to reach that degree prior to considering price cuts. He has formerly claimed that monetary plan operates with “long and variable lags,” indicating that waiting up until rising cost of living strikes 2% can be far too late to stop it from overshooting.

Jeffrey Roach, the primary economic expert for LPL Financial (LPLA), stated in a note Monday that the preliminary offer will “supply some clarity on the future course of inflation.” Yet he additionally stated “the uncertainty about what might occur after these short-term trade offers makes things tough for the Fed because stagflation remains a danger.”

And while inflation is much down from its height, it’s still sticky– especially in areas such as real estate and services, which have a tendency to be slower to readjust. Deutsche Financial Institution (DB) expert Jim Reid wrote in a note Tuesday that while toll cuts can aid reduced rising cost of living, other variables– such as sector-specific tolls and a weak buck– might drive inflation higher. Deutsche Bank anticipates the Fed to remain cautious in the meantime.

Daniel Hornung, previous Replacement Director of the National Economic Council, stated in a note Tuesday that, “The concerns currently are how much rising cost of living boosts when the tariffs obtain travelled through to customers, how much that strikes actual income and usage, and whether the economic climate can withstand those effects without going into an economic downturn.”

The brand-new inflation shows that core CPI– which removes out food and energy– rose simply 0.24% month-over-month, listed below expectations, and came in at 2.78% year-over-year. Planes tickets dropped by 2.8%, potentially due to softer need for service and tourism traveling. Used vehicle rates, long a hotbed for inflation, dropped by 0.5%.

Trade War Impact on Inflation

And while today’s tariffs truce could relieve some inflationary problems, it’s not likely to spur the Fed right into acting right away. The actual question is whether the worldwide economy will certainly cool down enough for the Fed to act emphatically.

In spite of the trade war is afraid that have actually controlled recent weeks, far more than tolls drive inflation. High costs for power and housing, persistent supply chain concerns, and labor market rigidity all contribute to inflationary stress that the Fed needs to take into consideration. The united state economy acquired by 0.3% in the very first quarter of 2025, while the labor market revealed strength with 177,000 jobs included April– a figure that modestly surpassed assumptions.

David Mericle, the chief U.S. economic expert at Goldman Sachs (GS) claimed in a note Monday that with tolls going down faster than expected, the Fed will not feel any kind of necessity to cut prices to boost financial activity. Goldman currently expects the Fed to start a series of three rate cuts also later than formerly believed– in December, as opposed to July– and to room them out at every other meeting, instead of in fast sequence.

Economic Strength and Rate Cut Expectations

“The economy itself is in strong shape,” Powell said at the central bank’s conference last month. He included, to some laughs from press reporters, that “my intestine informs me that uncertainty concerning the course of the economic situation is very raised.”

Trump’s pressure on the Fed to reduce rates has actually been progressively harmful and tremendous. Given that taking workplace, he has consistently gotten in touch with Jerome Powell to lower the base rate– which currently sits in between 4.25% and 4.5%– and at times has actually increased the legitimately uncertain possibility of ousting him.

It’s not just the trade war influencing the Fed. Deutsche Bank anticipates the Fed to continue to be careful for currently.

“In our brand-new economic standard, the reason for rate cuts changes from ‘insurance coverage’ to ‘normalization,'” Mericle composed. “As growth holds up and unemployment climbs much less sharply, the demand for hostile policy support decreases.”

Fed’s Cautious Stance and Market Reaction

High costs for power and housing, persistent supply chain problems, and labor market rigidity all add to inflationary stress that the Fed has to consider.” The Fed meeting came and went largely as expected,” Jeremy Siegel, financing professor at the Wharton College, composed Monday in his once a week column. … His rejection to shift plan discloses a broader problem: the Fed’s rigid functional framework has locked it into a reactive stance.”

“The Fed meeting came and went mainly as anticipated,” Jeremy Siegel, money teacher at the Wharton School, wrote Monday in his regular column. “Those wishing for clearness on a course for rates cuts just got verification Jerome Powell stays reluctant to act. … His refusal to move policy discloses a wider problem: the Fed’s rigid operational framework has secured it right into a responsive position.”

1 car tariffs2 cut interest rates

3 Economic Outlook

4 Federal Reserve

5 Inflation Reduction Act

6 Jerome Powell

« Trade Truce Impact: Market Belief & Economic UncertaintyUS Economy: Uncertainty, Trade, and Market Trends »